- Overview

- Interactive Chart

- Performance

- Risk and Rating

- Portfolio

- Management Team

- Fee

- Historical Price &

Dividend - Print

- Key Fact Statement

- Glossary

|

| Performance History | 30/04/2025 |

| Growth of 1,000(EUR) | Advanced Graph |

|

|

|

| • | Fund | 21.07 | -23.46 | 8.06 | 4.77 | 0.45 |

| • | +/-Cat | -5.60 | -0.51 | -0.77 | 1.47 | -1.52 |

| • | +/-Idx | 0.49 | -0.96 | -6.38 | 0.22 | -4.90 |

| Category: Europe ex-UK Small/Mid-Cap Equity | ||||||

| Index: Morningstar Developed Europe ex-UK Small Cap Target Market Exposure NR EUR | ||||||

| Trailing Returns | 15/05/2025 | |||||

| Fund | +/-Idx | |||||

| YTD | 5.75 | -4.77 | ||||

| 3 Years | 14.28 | -9.63 | ||||

| 5 Years | 41.14 | -26.39 | ||||

| 10 Years | 64.27 | -25.08 | ||||

| 12 Month Yield | 0.00 | |||||

| Dividend Paying Frequency | Semi-Annually | |||||

| Key Stats | ||

Morningstar Category

Europe ex-UK Small/Mid-Cap Equity

Morningstar Rating™

ISIN

GB00B3NSX137

NAV 15/05/2025

EUR 63.1300

Day Change

0.11%

Total Net Assets (mil)

30/04/2025

USD 589.04

USD 589.04

Front Load Fee

3.00%

Deferred Load Fee

-

Manager Name

William Cuss

Colin Riddles

Rosemary Simmonds

Nicholas Williams

Inception Date

15/10/2009

| Benchmark | ||||

| ||||

| Investment strategy |

| The investment objective of the Trust is to achieve capital growth by investing in Europe excluding the United Kingdom. The Trust will seek to achieve its investment objective by investing at least 75% of its total assets directly and indirectly in equities and equity-related securities of smaller companies incorporated in, or exercising the predominant part of their economic activity in Europe excluding the United Kingdom, or quoted or traded on the stock exchanges in Europe excluding the United Kingdom. Smaller European companies can be defined as those companies which are constituents of the bottom 30% of total market capitalisation of Europe’s listed companies (this excludes companies in the United Kingdom). |

| Portfolio Profile | 31/03/2025 |

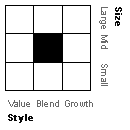

| Morningstar Style Box®_Morningstar: | |||||

| Equity Style | |||||

|

|||||

| Asset Allocation % | |||

| % Long | % Short | % Net Assets | |

| Stocks | 95.08 | 0.00 | 95.08 |

| Bonds | 0.00 | 0.00 | 0.00 |

| Cash | 4.98 | 0.06 | 4.92 |

| Other | 0.00 | 0.00 | 0.00 |

|

|

|||||||||||||||||||

| Top 5 Holdings | Sector | % |

ASR Nederland NV

ASR Nederland NV

|

Financial Services

Financial Services

|

2.48 |

Hera SpA

Hera SpA

|

Utilities

Utilities

|

2.26 |

Lottomatica Group SpA

Lottomatica Group SpA

|

Consumer Cyclical

Consumer Cyclical

|

2.15 |

Bankinter SA

Bankinter SA

|

Financial Services

Financial Services

|

2.13 |

Scout24 SE

Scout24 SE

|

Communication Services

Communication Services

|

2.02 |

|

| ||

| For the market value of financial derivatives, Morningstar's calculation method includes the nominal value of derivative agreements to reflect position-holding (position) for your reference. If the position-holding ranking calculated by Morningstar shall be different from that published by the fund company, the ranking in the monthly report (click here) by the fund company shall prevail. | ||

Price Chart

- Baring Europe Select Trust (EUR)

| Annual Returns | 30/04/2025 | |||||||

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

| Total Return | -11.88 | 26.79 | 6.20 | 21.07 | -23.46 | 8.06 | 4.77 | 0.45 |

| +/- Category | 5.31 | 0.63 | -8.35 | -5.60 | -0.51 | -0.77 | 1.47 | -1.52 |

| +/- Index | 3.98 | -3.43 | -2.67 | 0.49 | -0.96 | -6.38 | 0.22 | -4.90 |

| % Rank (Rel to Cat) | 12 | 62 | 77 | 78 | 53 | 61 | 42 | 33 |

| Trailing Returns | 15/05/2025 | |||

| Total Return | +/- Category | +/- Index | ||

| 1 Day | 0.11 | -0.06 | -0.14 | |

| 1 Week | 2.65 | 0.18 | 0.14 | |

| 1 Month | 9.75 | -0.44 | 0.38 | |

| 3 Months | -1.45 | -1.18 | -4.21 | |

| 6 Months | 6.30 | -0.12 | -4.64 | |

| YTD | 5.75 | -0.30 | -4.77 | |

| 1 Year | 1.71 | -1.46 | -5.25 | |

| 3 Years | 14.28 | -3.69 | -9.63 | |

| 5 Years | 41.14 | -28.32 | -26.39 | |

| 10 Years | 64.27 | -28.21 | -25.08 | |

| Category:Europe ex-UK Small/Mid-Cap Equity | ||||

| Index:Morningstar Developed Europe ex-UK Small Cap Target Market Exposure NR EUR | ||||

| Quarterly Returns | 30/04/2025 | |||

| Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 | |

| 2025 | -0.69 | - | - | - |

| 2024 | 6.12 | -1.32 | 2.73 | -2.61 |

| 2023 | 6.39 | -1.69 | -3.25 | 6.78 |

| 2022 | -13.79 | -14.13 | -8.27 | 12.72 |

| Dividend | 15/05/2025 |

| 12 Month Yield | 0.00 |

| 2025 | - |

| 2024 | 0.21 |

| 2023 | 0.53 |

| 2022 | 0.60 |

| Morningstar Rating™ Relative to Category | 30/04/2025 |

| 3-Year |

|

| 5-Year |

|

| 10-Year |

|

| Overall |

|

| Volatility Measurements | 30/04/2025 | |||||||||||||||||||||||||

|

||||||||||||||||||||||||||

| Investment Style Details | 31/03/2025 | |||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||

| Category: Europe ex-UK Small/Mid-Cap Equity | ||||||||||||||||||||||||||||||||||||||||

| AssetAllocation | 31/03/2025 |

|

|

|

|||||||||||||||||||||

| World Regions | 31/03/2025 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Category: Europe ex-UK Small/Mid-Cap Equity | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock Sector Weightings | 31/03/2025 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Category: Europe ex-UK Small/Mid-Cap Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Top 10 Holdings | 31/03/2025 |

| Portfolio | |

| Total Number of Equity Holdings | 97 |

| Total Number of Bond Holdings | 0 |

| Assets in Top 10 Holdings % | 20.18 |

| Product Name | Sector | Country/Region | % of Assets | ||

ASR Nederland NV

ASR Nederland NV

|

Financial Services

Financial Services

|

Netherlands | 2.48 | ||

Hera SpA

Hera SpA

|

Utilities

Utilities

|

Italy | 2.26 | ||

Lottomatica Group SpA

Lottomatica Group SpA

|

Consumer Cyclical

Consumer Cyclical

|

Italy | 2.15 | ||

Bankinter SA

Bankinter SA

|

Financial Services

Financial Services

|

Spain | 2.13 | ||

Scout24 SE

Scout24 SE

|

Communication Services

Communication Services

|

Germany | 2.02 | ||

Euronext NV

Euronext NV

|

Financial Services

Financial Services

|

Italy | 1.90 | ||

FinecoBank SpA

FinecoBank SpA

|

Financial Services

Financial Services

|

Italy | 1.89 | ||

Avolta AG

Avolta AG

|

Consumer Cyclical

Consumer Cyclical

|

Switzerland | 1.89 | ||

Aryzta AG

Aryzta AG

|

Consumer Defensive

Consumer Defensive

|

Switzerland | 1.80 | ||

Koninklijke Vopak NV

Koninklijke Vopak NV

|

Energy

Energy

|

Netherlands | 1.66 | ||

|

|

|||||

| Category: Europe ex-UK Small/Mid-Cap Equity | |||||

| For the market value of financial derivatives, Morningstar's calculation method includes the nominal value of derivative agreements to reflect position-holding (position) for your reference. If the position-holding ranking calculated by Morningstar shall be different from that published by the fund company, the ranking in the monthly report (click here) by the fund company shall prevail. | |||||

| Management Team | |||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

| Biography | |||||||||||||||||||||||||||||

| William Cuss is an Investment Manager on Barings’ Small Cap Equity team and co-manager of the Barings Europe Select Trust, the Barings European Opportunities Fund and the Barings International Small Cap strategy. He has worked in the industry since 2014. William joined the firm in 2016 from Investec, where he was an Equity Analyst, focusing on the European consumer staples sector. Previously, William worked as an auditor for Ernst & Young, where he qualified as a Chartered Accountant. William holds a BA (Hons) in History and Politics from the University of Warwick and is a member of the CFA Institute. | |||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

| Biography | |||||||||||||||||||||||||||||

| Colin is a Portfolio manager in the Small Cap Equity Team and co-manager of the Barings Europe Select Trust, the Barings European Opportunities Fund and the Barings International Small Cap strategy. He joined Barings in March 2010 from GLG, where he was responsible for their UK Small Company Fund. Previously, he worked at HSBC Halbis, Scottish Widows and General Accident. Colin has a BA (Hons) in Financial Studies & Computer Science, an MSc in Investment Analysis from Stirling University and an MBA from Edinburgh Business School. He is a member of the CFA UK. | |||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

| Biography | |||||||||||||||||||||||||||||

| Rosie is a Portfolio manager in the Small Cap Equity Team, co-manager of the Barings Europe Select Trust, the Barings European Opportunities Fund and the Barings International Small Cap strategy. Rosie joined Barings in September 2010 from Baillie Gifford where she worked for three years as an Investment Analyst. Rosie graduated from Oxford University with a degree in Modern History. She was awarded the IMC certificate in 2009 and is a CFA Charterholder. | |||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

| Biography | |||||||||||||||||||||||||||||

| Nick is Head of Small Cap Equities and co-manager of the Barings Europe Select Trust, the Barings European Opportunities Fund and the Barings International Small Cap strategy. He joined Barings in 2004, having previously worked for 11 years at Singer & Friedlander, where he was Head of the European desk and a member of the Investment Policy Committee. During his tenure at Singer & Friedlander, Nick was responsible for managing both institutional and retail European funds across the capitalisation range. Nick has a BA (Hons) in English Language and Literature from Corpus Christi College, Oxford. | |||||||||||||||||||||||||||||

| Fees and Expenses | ||||||||||||

| ||||||||||||

Disclaimer and Important Notes:

- Wealth Management Products are not deposits and have investment risks, and customers should be cautious in making any investment.

- Structured Deposit is different from ordinary deposits and has investment risks, and customers should be aware of the investment risk and cautious in making any investment.

- The relevant information and data displayed in the pages are for reference only and are those of the offshore funds, under Participation Non-Principal Protected Structured Investment Product, invested by QDII product-overseas fund series issued by DBS China, as well as of the onshore funds distributed by DBS China (as the case may be). Unless otherwise specified, all content in the webpages is provided by Morningstar Shenzhen Ltd (“Morningstar”), and it is possible to be modified without any notice. Some information provided by Morningstar to the pages may differ from the original data due to technical or operational reasons. DBS Bank (China) Limited (“DBS China”) has not verified, monitored or endorsed any content on any page and will not give any guarantee or warranty of whatsoever nature in respect of the correctness, completeness, or timeliness of any content on any page.

- Nothing on this page shall constitute an offer or invitation or solicitation to subscribe any product or fund or to enter into any transaction. The content on this page does not have regard to the specific investment objectives, financial situation or particular needs of any specific person and is not intended to provide, and should not be relied upon for accounting, legal or tax advice, or investment recommendations and is not to be taken in substitution for the exercise of judgment by the reader, who should obtain separate legal or financial advice. DBS China does not act as an adviser or assume any fiduciary responsibility or liability for any consequences financial or otherwise.

- Investment involves risks and the risk of loss from investment can be substantial. Opinions and estimates are subject to change without notice. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment. Before entering into any transaction or making a commitment to purchase any product mentioned on this page, the reader should take steps to ensure that the reader understands the transaction and has made an independent assessment of the appropriateness of the transaction in the light of the reader’s own objectives and circumstances. In particular, the reader should read all relevant documentation pertaining to the product (including but not limited to product offering documents, term sheets, prospectuses or other similar or equivalent offer or issue documents, as the case may be) and may wish to seek advice from a financial or other professional adviser or make such independent investigations as the reader considers necessary or appropriate for such purposes. If the reader chooses not to do so, the reader should consider carefully whether any product mentioned in the webpages is suitable for him. DBS China shall not assume any liability for any loss or damage (whether direct or indirect) of any person arising out of or in connection with any error, omission, delay and/or reliance on any content of any page.

Industrials

Industrials Basic Materials

Basic Materials Technology

Technology Cyclical

Cyclical Real Estate

Real Estate Sensitive

Sensitive Defensive

Defensive Healthcare

Healthcare