- Overview

- Interactive Chart

- Performance

- Risk and Rating

- Portfolio

- Management Team

- Fee

- Historical Price &

Dividend - Print

- Key Fact Statement

- Glossary

|

| Performance History | 31/03/2025 |

| Growth of 1,000(AUD) | Advanced Graph |

|

|

|

| • | Fund | 5.48 | -17.82 | 10.19 | 7.27 | -1.75 |

| • | +/-Cat | -1.83 | -3.67 | -0.14 | -0.20 | - |

| • | +/-Idx | - | - | - | - | - |

| Category: Other Allocation | ||||||

| Index: - | ||||||

| Trailing Returns | 29/04/2025 | |||||

| Fund | +/-Idx | |||||

| YTD | 0.18 | - | ||||

| 3 Years | 9.31 | - | ||||

| 5 Years | 28.50 | - | ||||

| 10 Years | 40.19 | - | ||||

| 12 Month Yield | 0.00 | |||||

| Dividend Paying Frequency | - | |||||

| Key Stats | ||

Morningstar Category

Other Allocation

Morningstar Rating™

Not Rated

ISIN

LU0468326631

NAV 29/04/2025

AUD 21.7300

Day Change

0.28%

Total Net Assets (mil)

31/03/2025

USD 14956.36

USD 14956.36

Front Load Fee

3.00%

Deferred Load Fee

-

Manager Name

Rick Rieder

Russ Koesterich

Inception Date

22/01/2010

| Benchmark | ||||

| ||||

| Investment strategy |

| The Fund seeks to maximise total return. The Fund invests globally in equity, debt and short term securities, of both corporate and governmental issuers, with no prescribed limits. In normal market conditions the Fund will invest at least 70% of its total assets in the securities of corporate and governmental issuers. The Fund generally will seek to invest in securities that are, in the opinion of the Investment Adviser, undervalued. The Fund may also invest in the equity securities of small and emerging growth companies. The Fund may also invest a portion of its debt portfolio in high yield fixed income transferable securities. Currency exposure is flexibly managed. |

| Portfolio Profile | 31/03/2025 |

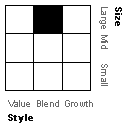

| Morningstar Style Box®_Morningstar: | |||||

| Equity Style | |||||

|

|||||

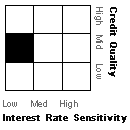

| Morningstar Style Box®_Morningstar: | |||||

| Fixed Income Style | |||||

|

|||||

|

||||||||||||||||||||||||

|

||||||||||

|

|

|||||||||||||||||||

| Top 5 Holdings | Sector | % |

5 Year Treasury Note Future June 25

5 Year Treasury Note Future June 25

|

|

3.45 |

Euro Bobl Future June 25

Euro Bobl Future June 25

|

|

3.15 |

OIS 18-JUN-2025 PAY

OIS 18-JUN-2025 PAY

|

|

2.67 |

E-mini S&P 500 Future June 25

E-mini S&P 500 Future June 25

|

|

2.61 |

4.06875 14-JAN-2027 RECEIVE

4.06875 14-JAN-2027 RECEIVE

|

|

2.04 |

|

| ||

| For the market value of financial derivatives, Morningstar's calculation method includes the nominal value of derivative agreements to reflect position-holding (position) for your reference. If the position-holding ranking calculated by Morningstar shall be different from that published by the fund company, the ranking in the monthly report (click here) by the fund company shall prevail. | ||

Price Chart

- BGF Global Allocation A2 AUD H

| Annual Returns | 31/03/2025 | |||||||

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

| Total Return | -9.49 | 15.46 | 17.16 | 5.48 | -17.82 | 10.19 | 7.27 | -1.75 |

| +/- Category | -2.88 | 0.58 | 9.65 | -1.83 | -3.67 | -0.14 | -0.20 | - |

| +/- Index | - | - | - | - | - | - | - | - |

| % Rank (Rel to Cat) | - | - | - | - | - | - | - | - |

| Trailing Returns | 29/04/2025 | |||

| Total Return | +/- Category | +/- Index | ||

| 1 Day | 0.28 | 0.61 | - | |

| 1 Week | 3.23 | 3.14 | - | |

| 1 Month | 1.02 | 3.03 | - | |

| 3 Months | -1.98 | -0.14 | - | |

| 6 Months | -0.46 | 5.59 | - | |

| YTD | 0.18 | 2.21 | - | |

| 1 Year | 5.33 | 11.43 | - | |

| 3 Years | 9.31 | 8.60 | - | |

| 5 Years | 28.50 | 1.02 | - | |

| 10 Years | 40.19 | -61.91 | - | |

| Category:Other Allocation | ||||

| Index: | ||||

| Quarterly Returns | 31/03/2025 | |||

| Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 | |

| 2025 | -1.75 | - | - | - |

| 2024 | 4.95 | 0.90 | 3.27 | -1.90 |

| 2023 | 3.00 | 2.86 | -4.12 | 8.48 |

| 2022 | -6.27 | -12.23 | -4.68 | 4.80 |

| Dividend | 29/04/2025 |

| 12 Month Yield | 0.00 |

| Morningstar Rating™ Relative to Category | - |

| 3-Year | Not Rated |

| 5-Year | Not Rated |

| 10-Year | Not Rated |

| Overall | Not Rated |

| Volatility Measurements | 30/04/2025 | |||||||||||||||

|

||||||||||||||||

| Investment Style Details | 31/03/2025 | |||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||

| Category: Other Allocation | ||||||||||||||||||||||||||||||||||||||||

| Fixed Income Style | 31/03/2025 | ||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||

| Category: Other Allocation | |||||||||||||||||||||||||||||||||

| AssetAllocation | 31/03/2025 |

|

|

|

|||||||||||||||||||||

| World Regions | 31/03/2025 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Category: Other Allocation | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock Sector Weightings | 31/03/2025 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Category: Other Allocation | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Top 10 Holdings | 31/03/2025 |

| Portfolio | |

| Total Number of Equity Holdings | 642 |

| Total Number of Bond Holdings | 1457 |

| Assets in Top 10 Holdings % | 23.67 |

| Product Name | Sector | Country/Region | % of Assets | ||

5 Year Treasury Note Future June 25

5 Year Treasury Note Future June 25

|

|

United States | 3.45 | ||

Euro Bobl Future June 25

Euro Bobl Future June 25

|

|

Germany | 3.15 | ||

OIS 18-JUN-2025 PAY

OIS 18-JUN-2025 PAY

|

|

United States | 2.67 | ||

E-mini S&P 500 Future June 25

E-mini S&P 500 Future June 25

|

|

United States | 2.61 | ||

4.06875 14-JAN-2027 RECEIVE

4.06875 14-JAN-2027 RECEIVE

|

|

United States | 2.04 | ||

3.791500 29-MAR-2029 RECEIVE

3.791500 29-MAR-2029 RECEIVE

|

|

United States | 1.95 | ||

4.213800 27-OCT-2026 RECEIVE

4.213800 27-OCT-2026 RECEIVE

|

|

United States | 1.94 | ||

Apple Inc

Apple Inc

|

Technology

Technology

|

United States | 1.89 | ||

Germany (Federal Republic Of) 2.3%

Germany (Federal Republic Of) 2.3%

|

|

Germany | 1.88 | ||

Microsoft Corp

Microsoft Corp

|

Technology

Technology

|

United States | 1.87 | ||

|

|

|||||

| Category: Other Allocation | |||||

| For the market value of financial derivatives, Morningstar's calculation method includes the nominal value of derivative agreements to reflect position-holding (position) for your reference. If the position-holding ranking calculated by Morningstar shall be different from that published by the fund company, the ranking in the monthly report (click here) by the fund company shall prevail. | |||||

| Management Team | |||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

| Biography | |||||||||||||||||||||||||||||

| Senior Managing Director, is BlackRock's Chief Investment Officer of Global Fixed Income, Head of the Fundamental Fixed Income business, and Head of the Global Allocation Investment Team. Responsible for roughly $2.4 trillion in assets, Mr. Rieder is a member of BlackRock’s Global Executive Committee (GEC) and its GEC Investments Sub-Committee. He is also a member of BlackRock's Global Operating Committee, and Chairman of the firm-wide BlackRock Investment Council. Before joining BlackRock in 2009, Mr. Rieder was President and Chief Executive Officer of R3 Capital Partners. He served as Vice Chairman and member of the Borrowing Committee for the U.S. Treasury and member of the Federal Reserve’s Investment Advisory Committee on Financial Markets. Mr. Rieder currently serves on the Alphabet/Google Investment Advisory Committee and the UBS Research Advisory Board. He has been awarded the 2023 Outstanding Portfolio Manager by Morningstar, was nominated for Outstanding Portfolio Manager by Morningstar in 2021, was awarded the Global Unconstrained Fixed Income Manager of the Year for 2015 by Institutional Investor, was nominated for Fixed Income Manager of the Year by Institutional Investor for 2014, and was inducted into the Fixed Income Analysts Society Fixed Income Hall of Fame in 2013. Four of the funds Mr. Rieder manages (Strategic Income Opportunities, Fixed Income Global Opportunities, Total Return, and Strategic Global Bond) have been awarded Gold Medals by Morningstar. From 1987 to 2008, Mr. Rieder was with Lehman Brothers, most recently as head of the firm's Global Principal Strategies team, a global proprietary investment platform. He was also global head of the firm's credit businesses, Chairman of the Corporate Bond and Loan Capital Commitment Committee, and a member of the Board of Trustees for the corporate pension fund. Before joining Lehman Brothers, Mr. Rieder was a credit analyst at SunTrust Banks in Atlanta. Mr. Rieder earned a BBA degree in Finance from Emory University in 1983 and an MBA degree from The Wharton School of the University of Pennsylvania in 1987. He is a member of the board of Emory University, Emory's Goizueta Business School, and the University's Finance Committee, and is the Vice Chairman of the Investment Committee. Mr. Rieder is founder and chairman of the Goizueta Business School's BBA investment fund and community financial literacy program, Graduation Generation Public School Collaboration in Atlanta. Mr. Rieder serves as Chairman and President of the Board of Education for North Star Academy's fourteen Charter Schools in Newark, New Jersey. He is on the Board of the BlackRock Foundation, the Board of Advisors for the Hospital for Special Surgery, and the Board of Big Brothers/Big Sisters of Newark and Essex County. Mr. Rieder formerly served on the Board and National Leadership Council of the Communities in Schools Educational Foundation, and Trustee for the US Olympic Foundation. | |||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

| Biography | |||||||||||||||||||||||||||||

| "Russ Koesterich, CFA, JD, Managing Director and portfolio manager, is a member of the Global Allocation team as well as the lead portfolio manager on the GA Selects model portfolio strategies. Mr. Koesterich's service with the firm dates back to 2005, including his years with Barclays Global Investors (BGI), which merged with BlackRock in 2009. He joined the BlackRock Global Allocation team in 2016 as Head of Asset Allocation and was named a portfolio manager of the Fund in 2017. Previously, he was BlackRock's Global Chief Investment Strategist and Chairman of the Investment Committee for the Model Portfolio Solutions business, and formerly served as the Global Head of Investment Strategy for scientific active equities and as senior portfolio manager in the US Market Neutral Group. Prior to joining BGI, Mr. Koesterich was the Chief North American Strategist at State Street Bank and Trust. He began his investment career at Instinet Research Partners where he occupied several positions in research, including Director of Investment Strategy for both U.S. and European research, and Equity Analyst. He is a frequent contributor to financials news media and the author of three books, including his most recent ""Portfolio Construction for Today's Markets."" Mr. Koesterich earned a BA in history from Brandeis University, a JD from Boston College and an MBA from Columbia University. He is a CFA Charterholder." | |||||||||||||||||||||||||||||

| Fees and Expenses | ||||||||||||

| ||||||||||||

Disclaimer and Important Notes:

- Wealth Management Products are not deposits and have investment risks, and customers should be cautious in making any investment.

- Structured Deposit is different from ordinary deposits and has investment risks, and customers should be aware of the investment risk and cautious in making any investment.

- The relevant information and data displayed in the pages are for reference only and are those of the offshore funds, under Participation Non-Principal Protected Structured Investment Product, invested by QDII product-overseas fund series issued by DBS China, as well as of the onshore funds distributed by DBS China (as the case may be). Unless otherwise specified, all content in the webpages is provided by Morningstar Shenzhen Ltd (“Morningstar”), and it is possible to be modified without any notice. Some information provided by Morningstar to the pages may differ from the original data due to technical or operational reasons. DBS Bank (China) Limited (“DBS China”) has not verified, monitored or endorsed any content on any page and will not give any guarantee or warranty of whatsoever nature in respect of the correctness, completeness, or timeliness of any content on any page.

- Nothing on this page shall constitute an offer or invitation or solicitation to subscribe any product or fund or to enter into any transaction. The content on this page does not have regard to the specific investment objectives, financial situation or particular needs of any specific person and is not intended to provide, and should not be relied upon for accounting, legal or tax advice, or investment recommendations and is not to be taken in substitution for the exercise of judgment by the reader, who should obtain separate legal or financial advice. DBS China does not act as an adviser or assume any fiduciary responsibility or liability for any consequences financial or otherwise.

- Investment involves risks and the risk of loss from investment can be substantial. Opinions and estimates are subject to change without notice. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment. Before entering into any transaction or making a commitment to purchase any product mentioned on this page, the reader should take steps to ensure that the reader understands the transaction and has made an independent assessment of the appropriateness of the transaction in the light of the reader’s own objectives and circumstances. In particular, the reader should read all relevant documentation pertaining to the product (including but not limited to product offering documents, term sheets, prospectuses or other similar or equivalent offer or issue documents, as the case may be) and may wish to seek advice from a financial or other professional adviser or make such independent investigations as the reader considers necessary or appropriate for such purposes. If the reader chooses not to do so, the reader should consider carefully whether any product mentioned in the webpages is suitable for him. DBS China shall not assume any liability for any loss or damage (whether direct or indirect) of any person arising out of or in connection with any error, omission, delay and/or reliance on any content of any page.

Financial Services

Financial Services Consumer Cyclical

Consumer Cyclical Industrials

Industrials Healthcare

Healthcare Cyclical

Cyclical Basic Materials

Basic Materials Real Estate

Real Estate Sensitive

Sensitive Communication Services

Communication Services Energy

Energy Defensive

Defensive Consumer Defensive

Consumer Defensive Utilities

Utilities